The Mighty Roth IRA

& 4 ways high income earners contribute

An IRA, short for Individual Retirement Arrangement, is a retirement account that shares many of the tax-advantages of a 401(k).

A Roth IRA shares many of the tax advantages of a Roth 401(k). While contributions are made with after-tax dollars, meaning there is no tax benefit up front the growth (dividends, interest, and capital gains) are completely tax-free. Qualified distributions are also tax-free. That means money inside a Roth IRA is never taxed again, and the tax benefits can compound significantly over time.

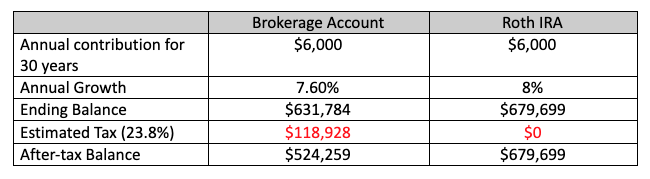

Tax benefits of IRAs. Taxation of withdrawals from brokerage account is assumed to be capital gains tax.

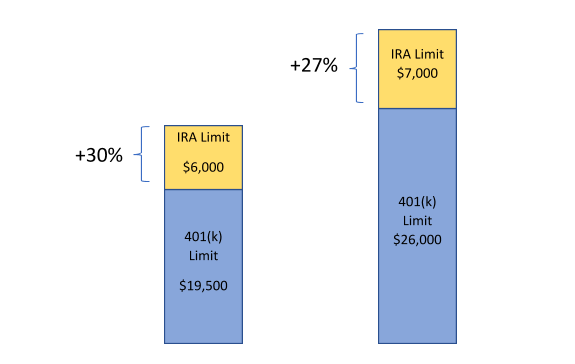

Contributions to IRAs typically must be made by April 15th of the following year (i.e. 2020 contributions are due 4/15/2021). The contribution limit for IRAs in 2020 and 2021 is $6,000, or $7,000 if you are 50 or older. This contribution limit applies across both traditional and Roth IRAs. You can contribute to both a traditional IRA and Roth IRA, but the combined amount cannot be over $6,000.

While the contribution amount is lower compared to the contribution limits on 401(k)s, IRA contributions can be made in addition to your 401(k) contribution. In other words, you can contribute $19,500 (in 2020 and 2021) to your Roth 401(k), and contribute $6,000 to your Roth IRA. An IRA allows you to contribute 30% more every year to a tax-advantaged account!

2020 and 2021 contribution limits. IRA can increase contribution limit by 30%

Quantifying the “MIGHT” of backdoor Roth IRAs

To illustrate the tax savings, let’s take a look at an example.

Emmitt contributes $6,000 to a regular brokerage account each year for the next 30 years. If the account grows at an average rate of 8%, the ending balance would be just under $680,000. Emmitt is a high-income earner, and the gain of $500,000 ($680,000 - $180,000) is taxed at the long-term capital gains rate of 23.8%, or roughly $120,000.

Emmitt contributes $6,000 to a Roth IRA each year for the next 30 years. The account grows at an average rate of 8%, and the ending balance is the same $680,000. However, there is no tax on the growth inside a Roth IRA, so Emmitt gets to keep the full $680,000.

Another benefit of a Roth IRA is that income and capital gains are tax-free. This comes in handy when it becomes necessary to rebalance the account since it can be done without concern for capital gains tax. It also allows the account to be invested in tax-inefficient asset classes that distribute a lot of income, such as real estate investment trusts (REITs).

Let’s say that due to capital gains and investment income tax on an annual basis, the brokerage account grows 5% less than the Roth IRA account. In that scenario, the difference between the brokerage account and Roth IRA account grows to $156,000.

Last but not least, many states tax capital gains, often at the same rate as income. The tax savings inside a Roth IRA becomes even greater if you live in a state with its own income tax. If we estimate state tax at 6%, the difference is over $180,000. $6,000 per year may not seem much, but don’t underestimate the power of compounding, the Roth IRA can be mighty!

Income limits

If you are single and your income is below $124,000, or married filing jointly and your income is below $196,000, you can open a Roth IRA and contribute directly into it. The maximum amount you can contribute is 100% of your earned income, up to $6,000, or $7,000 if you are 50 or older. Even if only one spouse has earned income, the other spouse can also make contributions to a Roth IRA if you are married filing jointly. For example, if one spouse earned $50,000 in 2020, both spouses can contribute $6,000 to each of their Roth IRAs.

The IRS does not allow high income earners to contribute directly to a Roth IRA. Your ability to contribute to a Roth is completely phased out if you make over $139,000 ($140,000 in 2021) as a single person, or $206,000 ($208,000 in 2021) as a married couple filing jointly.

But don’t quit there. High earners can contribute to their Roth IRA:

1) From their traditional IRA via a Roth conversion. There is no income limit nor annual limit on the amount you can convert. However, assuming the traditional IRA was made with pre-tax dollars, the amount of the conversion will be considered taxable income in the year the conversion is made.

Why would you want to pay tax to make a Roth conversion? It could be beneficial to make a Roth conversion if you have a low income year, say during COVID you had a few months of no income. An alternative scenario would be if you retire early and have several low income years before Social Security benefits and required minimum distributions kick in.

2) From their old Roth 401(k) via a rollover. Like a Roth conversion, there is no income limit nor annual limit on the amount you can rollover. Since the savings is going from a Roth to another Roth account, there is also no tax consequence. However, most employers will not allow you to rollover your Roth 401(k) if you are still employed, therefore the Roth 401(k) rollover will only be an option if you have separated from your employer.

3) From an after-tax 401(k) contribution via a Mega Backdoor Roth contribution. More information on an MBR contribution can be found in my prior blog post titled The Fabulous MBR (Mega Backdoor Roth).

4) The backdoor Roth IRA contribution is a two-step process for high earners to get NEW money into a Roth account. While the mechanics can be simple, there are a number of traps to avoid, and will be discussed in the next blog post.

Emmitt put in the same amount of effort and time, but the difference between knowing to use a Roth IRA and not, was a difference of $180,000. That is roughly an extra $1,204 per month, every month, over the next 20 years in retirement. Put annually, that is a $14,448 bonus every year for 20 years, purely in less tax.

The tax savings for Emmitt might be enough to fund a dream vacation to places he has never been EVERY YEAR, upgraded lifestyle with a new car or a home with an extra bedroom (we could all use an extra bedroom right now), better healthcare, the ability to help fund his grandchildren’s college savings, or a combination of ALL of the above!

If you are a high earner and wondering what else you might be missing, schedule a 15-minute call with me to discuss how I can help you optimize your finances.

Disclaimer: not tax, legal, or investment advice. Consult a professional.